PERSONAL FINANCE PROGRAMS

Five programs to make and save you money

By Jeffrey Daniels

Since

the advent of personal computers some ten years ago, we have all been bombarded

with pie-in-the-sky praises and hyperbolic promises of increased productivity,

both in the workplace and at home. And there can be no doubt that mainframes

and minis, as well as their tiny-tot offspring, have irrevocably reconstituted

the technological landscape and, though less dramatically, have come to

influence our day-to-day lives.

Since

the advent of personal computers some ten years ago, we have all been bombarded

with pie-in-the-sky praises and hyperbolic promises of increased productivity,

both in the workplace and at home. And there can be no doubt that mainframes

and minis, as well as their tiny-tot offspring, have irrevocably reconstituted

the technological landscape and, though less dramatically, have come to

influence our day-to-day lives.

Yet after all the hype and promise, what remains is that computers do one thing very very well - data manipulation. This rather unglamorous job description may be further refined to say that the tasks computers are most suited for are word processing, database management and financial analysis (and other forms of "number crunching").

The programs under review in this article fall into the last category- financial analysis. Two of the five, Financial Cookbook and The Isgur Portfolio, stand alone as specialized (though unrelated) programs dedicated to a particular financial project. The other three, Dollars And Sense, Personal Money Manager and Phasar are general accounting packages and will be reviewed later in this article.

FINANCIAL COOKBOOK

Financial Cookbook from Electronic Arts is a clever and useful, if

unabashedly limited, little financial tool. Its limitation should be neither

obstructive nor frustrating to the user in that the program purports to

be nothing more than it is: a quick-and-easy way to perform relatively

straightforward financial calculations and projections.

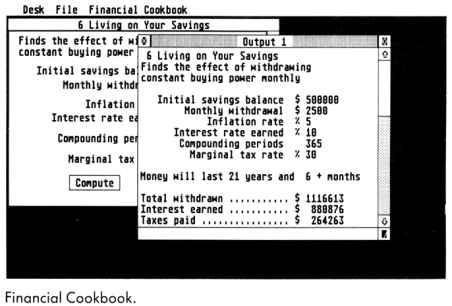

At the heart of the program are 32 "recipes" (hence the name cookbook). Cookbook's recipes are really plug-in financial templates, each of which is designed to do a specific job. You enter an appropriate set of parameters and instructs the computer to compute the answer based on the information entered. Dutifully and rather quickly, the program stirs the ingredients together and either displays its calculations on screen or prints them to a printer.

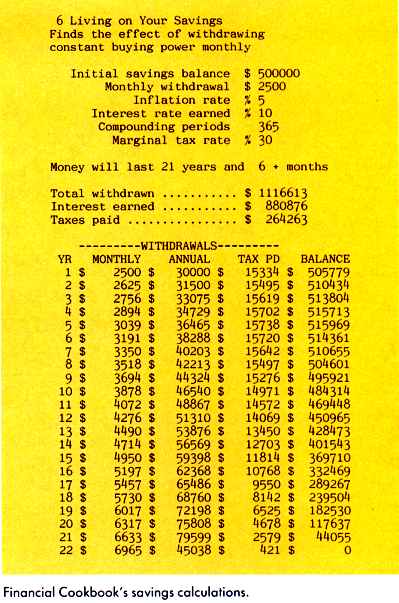

Let's take an example. Have you ever dreamed of living on your savings? If so, have you ever actually stopped to consider just how much you'd need to have on deposit, earning such-and-such an amount, say, monthly? And what about inflation? Perhaps $2,500 a month meets your needs today. But ten years hence, will that same $2,500 a month suffice? Probably not; at the very least, you'll want $2500 a month in 1988 dollars in order to preserve the buying power you have today for tomorrow And what about taxes? The interest your nest egg earns will, of course, be taxable. How much of that $2,500 in 1988 dollars will you be keeping after taxes ten years hence? Does a $500,000 nest egg sound like enough? Not to worry-Financial Cookbook will figure it all out for you.

To satisfy your curiosity, at right is Financial Cookbook's calculations for the present problem. How long do you think $500,000 will last earning 10% interest, projecting a 5% annual inflation rate, assuming a 30% marginal tax rate, and withdrawing $2,500 a month in constant 1988 dollars? Less time, I'm afraid, than you may care to know about.

(Jeez, how do those rich people do it?)

At any rate, Financial Cookbook is fun, simple and quite useful. There are recipes to calculate how regular monthly deposits grow over time, how deposits now will grow to have a given target amount of future buying power, how an IRA will grow over time and how long it will last once you start withdrawing from it, what the monthly mortgage payment is on a certain financed amount, what portion of that payment is paid in interest and how much reduces principal in time, the pros and cons of renting or buying one's home, the pros and cons of leasing or buying one's car, and many many others.

One criticism of the program is that much in these calculations is tax-related. The changes in the tax laws have certainly outdated the information, though not the program particularly. And one further note on the documentation: the program itself is obviously an IBM port (as so much of recent ST software seems to be). The manual, while clear and reasonably well-written, has not been revised for the ST. Little things, therefore, like command line for menu bar have been left unexpurgated.

THE ISGUR PORTFOLIO

Another IBM port, the Isgur Portfolio, is an investment portfolio program

that allows you to design and monitor several stock-and-bond portfolios.

The package includes two other programs as well: IS Bridge and IS Talk.

Let me say a few words about these before moving on to the main program.

The Bridge program allows you to link the Isgur Portfolio and Talk (as well as any other program in the IS series) according to your system configuration, in particular and most important, disk storage. The Bridge disk contains an installation program that provides you with a question-and-answer exchange about the current system and your installation preferences (on which disk will you put Portfolio? etc.). From the main Bridge screen you can run any IS program, and from any IS program you can exit to Bridge. Bridge also includes an easy-to-use memo pad and appointment calendar. The electronic mail system inherent in this feature allows Portfolio to leave messages for the user (for instance, you might specify in Portfolio that you wish to be notified when equity holdings become long-term positions).

IS Talk is a telecommunications program, which is a nice touch: those interested in computer-based portfolio managers inevitably gravitate to the on-line financial services now widely available. If you have an existing account with one of the major on-line quotation services, Portfolio can retrieve quotes independent of IS Talk. Thus Talk is included as a kind of bonus: you might wish to peruse these services for financial data and news other than straight quotes. (The manual also notes that if you aren't a current subscriber to one of the major services, you will have to use IS Talk to establish an account. However, and if memory serves me well, I recall completing the entire start-up transaction with Dow Jones News/Retrieval on the phone - that is, with voice communication-including receipt of my password.) IS Talk is a fairly simple and serviceable telecommunications package, and I can highly recommend it. Included in the package is a complimentary subscription to CompuServe. Another bonus.

Unfortunately, The isgur Portfolio program itself is less easy to recommend. The program isn't awful by any means; it's simply less than spectacular. It looks and feels cumbersome; the screens are cluttered and hard to decipher. and screen prompts and button labels are often not self-explanatory. The program is GEM-based, but it looks as though the IBM GEM interface has been ported in the ST implementation, along with the rest of the code. (The ST is such a fine piece of hardware. Why won't more developers sit down with the machine and write for it?) And while the program isn't riddled with bugs, it did inexplicably lock up on me more than once.

These critical remarks aside, Portfolio does track and update portfolios of stocks, bonds and options. Buys and sells, realized and unrealized gains and losses, cash and margin account management, calculation of dividends and splits, automatic or manual update of price quotes, year-end reports-it's all here, competently, if ploddingly, executed. But in the age of hotshot Wall Street gurus, there is no real capability of performing serious technical analysis included in the program.

One very nice feature is the program's macro utility dubbed Replay. With Replay, you can record a set of command moves within the program and then call for execution of that procedure at any time. This greatly enhances your speed in performing especially involved tasks (Talk also includes a Replay option). And the recording process is marvelously simple -you merely operate the program as you normally would. and Portfolio, having been previously given the Replay command, records every mouse movement, click, keystroke and pause for that procedure.

The Portfolio documentation is informative and careful not to move too fast, though at times I found myself wishing it would; the manual is a tad overwritten. And again, as an IBM port, the main text of the manual remains strewn with IBMese.

THE THREE ACCOUNTING PACKAGES

Now let us turn to the three general accounting packages under review:

Personal Money Manager, Phasar and Dollars And Sense. Of the three, Personal

Money Manager is the simplest and least sophisticated, and indeed bills

itself only as a computerized "personal accountant." Both Dollars And Sense

and Phasar introduce far more sophistication and accounting power, and

either is suitable for financial record keeping at home or for a small

business.

We'll begin with Personal Money Manager, in part because it's the simplest program and in part to contrast its limitations with the power and versatility of Dollars And Sense and Phasar

PERSONAL MONEY MANAGER

Personal Money Manager is really just an overblown checkbook register,

made unnecessarily complex by the author's insistence on using the standard

(among bookkeepers and accountants) "double entry" accounting system. Unless

you're familiar with the standard, you'll be at odds with double-entry

accounting from the start.

Every transaction requires two entries: one credit against an account and one debit against another. That sounds easy enough. However, because the program isn't smart enough to distribute a given entry to its matching debit or credit account, you're forced to make the entry without, possibly, the benefit of knowing (nowhere in the manual is it explained) that debit and credit are arbitrary categorizations that mean only the left side (debit) and the right side (credit) of a ledger account. In accounting parlance, these terms have no other meaning. And contrary to what the lay user may think, there is no positive implication inherent in credit nor is there any negative implication to debit, and vice versa.

This leads to the following protocol when setting up accounts and entering transactions. Personal Money Manager allows four types of Asset accounts: Checking, Savings, Cash and Charge, in all of which positive amounts are recorded as debits. No problem except that without knowing in advance about the formal semantic subtlety of debit and credit, you might be left to think, "Well, now, how can that be right? If I've got $2,000 in a savings account it feels to me more like a credit, certainly not a debit." And so it goes for Personal Money Manager Expense accounts. The program allows two types: Income and Expense, in each of which positive amounts are entered as credits. Again, no problem, but wouldn't you want to know why an income account is formally considered an expense account and why, for instance, an expense is entered as a credit? Expenses are sure to feel more like debits to the ininitiated user.

The real point here is that nowhere in the documentation are such potential confusions addressed. You'll find only a very brief set of expositions of the rules: ". . . Suppose you have $500 in your checking account. That shows up as a $500 debit in the (asset) checking account. If you got that $500 from a paycheck, it would appear as a $500 credit in the (expense) paycheck account." Huh?

If you're content to follow the rules, the program works just fine, but offers nothing more than the bookkeeper's standard journal and ledger The exception is that it's computerized, so for those bookkeepers out there with an aversion to pencils, this is the program for you.

The program is putatively GEM-based, but only its start-up screen. When you enter information, the interface is clearly unadorned, blinking black cursor TOS.

PHASAR

Phasar is an excellent, if ugly-looking, home/small business accounting

program, and uses the single-entry accounting system. This means that for

most transactions only one account is posted, but the posting is reported

according to specific categories of income or expense. This method plays

into your intuitive biases and allows you to work with the program without

the burden of having to unlearn lay financial concepts.

Indeed, the concern for the user by the people who put together Phasar reaches near-cloying levels. The tutorial (and much else in the manual) is written with the worst sort of "happy talk," and it will take a user more accustomed to being "condescended to" than I to get through it. Here's a sample. After completing the first real work in the tutorial, you're congratulated with these comforting remarks: "You deserve a pat on the back. You just completed a section of the tutorial. This would actually be a good time to take a break and digest the information presented so far (and maybe a snack, too). Meet you in the next section!"

Well, even if you're a little hungry after completing the first section, patronizing language like the above caused me to lose my appetite. And the pity of it is that much of the manual is written in the same style, replete with clever character and company names. To my mind, tutorials ought to be written with a minimum of such stuff, getting to the step-by-step instruction without delay.

However, once you get past the documentation, a straightforward, surprisingly powerful program is at your command. You begin, as with any of the accounting programs, with the job of setting up accounts and entering transactions. This is accomplished with a split-screen format in which the program presents you with a set of user-definable accounts (checking, savings, credit card(s), cash, etc.), You simply select the account and enter the transaction. The program keeps running balances, based on the type of transactions entered (income, expense or transfer), for each account. In the case of a transfer, for instance, from a checking account to a credit-card account (that is, you wish to pay all or part of your credit-card balance from your checking account), then you select the checking account, specify the payee and the amount, and the program automatically debits the checking account and credits the credit card account. Marvelously simple.

The program is also capable of splitting a given transaction between kinds of expenses. Suppose, for example, you shop frequently at a local variety store. You may purchase household items, clothing, groceries and automotive parts - all at the same store and all with the same check. Suppose, further, that you've set up expense budgets according to these categories. Phasar allows you to "split" an expended amount over multiple categories, thereby accurately tracking expenses incurred according to their specific categories.

As stated, the heart of any accounting program is how it handles accounts and transactions, and Phasar does all this with ease. Of course, there would be little advantage to a computerized accounting package if that were all it offered (as, for instance, Personal Money Manager almost does). How the program consolidates the information entered to produce statements and reports is the acid test for any financial program. I am pleased to report that Phasar offers a panoply of useful features of consolidation: you can automatically search accounts according to date, income or type of expense; confirm and reconcile your bank statement with the information entered; produce month-by-month or year-to-date reports; and perform budget analysis, which compares (and can graph) the user-defined budget for a given expense category against the actual amount expended. And there is much, much more.

The Phasar package also includes the PHTAX program, which, roughly, uses the income and expense transactions in Phasar to calculate taxes due. The program even includes an on-screen facsimile of the IRS's 1040 form, although Phasar allows you to design whatever tax forms you wish.

DOLLARS AND SENSE

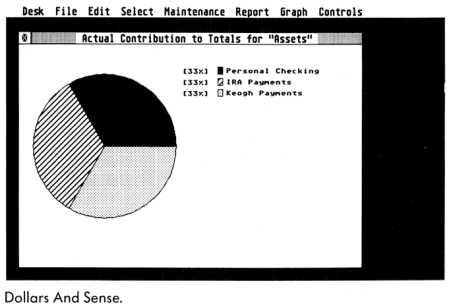

To me, the most ambitious, well-rounded package among the three accounting

packages here is Monogram's Dollars And Sense. While Phasar challenges

Dollars And Sense in pure computing and accounting power, the quality of

the latter's user-interface outstrips any of the other programs reviewed

here.

Dollars And Sense provides a true GEM-based user-interface and supports GDOS (Atari and Digital Research's Graphics Device Operating System), which allows you to display and print financial reports and graphs using custom fonts and device drivers. Unfortunately the current release of Dollars And Sense includes an early inferior version of GDOS, and GDOS font and driver support is available only for the Epson FX80 and compatible printers. Further, the program disk includes no screen fonts (though the ASSIGN.SYS File included on disk, strangely enough, does name a series of screen fonts for GDOS system use; but this listing is in fact of no use since the font files are not contained on disk. What's more, the program would not display the standard GDOS fonts I regularly use with other GDOS applications, but it would print them).

The fact that the program implements GDOS so poorly is not entirely Monogram's fault. Atari was notoriously late in its delivery of a final GDOS program, font and documentation release. I've been assured by Monogram that an updated version of Dollars And Sense is on the way and that the new version will more productively implement GDOS, as well as generally upgrade the product.

Dollars And Sense brings slightly more sophistication to the accounting process than does Phasar, and it looks better, but on the whole the two programs are neck-and-neck in overall power. Dollars And Sense uses the double-entry accounting system (every transaction has its opposite, but the program is smart enough, unlike Personal Money Manager, to automatically perform the second entry). Dollars And Sense differs from Phasar in that it uses an account-based system for transactions, whereas Phasar uses accounts and categories of expense and income. The net effect in Dollars And Sense is to more closely approximate a professional accountant's work, although the difference is more cosmetic than substantial, I suppose.

Since the range of tasks that either program can perform is so great, it's difficult to detail all or even most of either one's features. Dollars And Sense allows you to manage budgets, reconcile bank statements, prepare income statements and balance sheets, perform year-to-date summaries and a host of other tasks-even printing checks (although Phasar offers this feature, too). Setting up accounts and recording transactions is painless and easy to understand.

You first create an initial "umbrella" account file, which may include all account types: Assets, Checking. Expenses. Income and Liabilities. Once these accounts are established, you can give them beginning balances (with the exception of Expenses and Income) and monthly budgets. You can also set up variable budgets- that is, expenditures or income budgeted or received only intermittently during the year (as, for example, in the case of purchasing Christmas gifts or the receipt of a year-end bonus), And as when using Phasar, you can set up automatic transactions that represent fixed monthly expenditures or income, like a mortgage payment or paycheck deposit.

The consolidation and processing of information entered are one of the best features of Dollars And Sense. You can graph a series of reports for display to the screen or output to a GDOS-compatible printer, or such reports may be displayed as text or printed with a printer.

In sum, Dollars And Sense is a first-class ST application, and as soon as the program's GDOS problems are resolved, Monogram may well run away with the accounting market for the ST.

If you'd like to see more articles like this, circle 234 on the Reader Service Card.

Jeffrey Daniels is a free-lance writer who specializes in software documentation.

PRODUCTS MENTIONED

-

Financial Cookbook, $19.95; The Isgur Portfolio, $199.95. Electronic Arts,

1820 Gateway Drive, San Mateo, CA 94404, (415) 571-7171.

CIRCLE 180 ON READER SERVICE CARD -

Personal Money Manager, $49.95. MichTron, 576 S. Telegraph, Pontiac, MI

48053, (313) 334-5700.

CIRCLE 181 ON READER SERVICE CARD - Phasar, $89.95. Antic Software, 544 Second Street, San Francisco, CA 94107, (800) 234-7001.

-

Dollars And Sense, $99.95. Monogram, 531 Van Ness Avenue, Torrance, CA

90501, (213) 533-5120.

CIRCLE 182 ON READER SERVICE CARD