IBM Compatibles

The Universe Expands

Keith Ferrell, Features Editor

The compatibles are here. Offering options including large amounts of memory, bright colors and graphics, speeds sometimes in excess of the IBMs', and various software bundles, clone manufacturers are targeting American consumers with PCs that do more for less money. Will the PC become this year's hot electronic commodity? More than one manufacturer is betting on it.

Over the six years since IBM introduced its first PC, third-party manufacturers have cloned just about every part of it, including the name.

PC by now has come to stand for a computer capable of running programs that are managed by MS-DOS—Microsoft Disk Operating System. And in the PC universe, MS-DOS—thanks to the dozens of manufacturers and hundreds of software developers and publishers who have made it the standard—could almost be an acronym for Microsoft's Dominant Operating System.

Today, with MS-DOS and PCs the most widely accepted operating and hardware systems in American business, a large segment of the public has been exposed to computers that combine extravagant amounts of mass storage, spacious RAM, high operating speeds, and a number of sophisticated software applications.

From the office PC, consumers have taken home terms such as spreadsheet, database, word processing, and desktop publishing. Now, as a result of sharp and ongoing declines in the prices of both memory and hardware, they are beginning to take home their own PCs. The Personal Computer is on the verge of acquiring a personal market.

By the end of this year, consumers will be able to select from a large number of low-priced, high-power machines produced and distributed by established, healthy players such as Tandy/Radio Shack; young and aggressive companies such as Leading Edge, PC's Limited, Franklin, Victor, and Blue Chip; plus companies new to the American market, such as Vendex and Amstrad. Of the companies already established among consumers, both Atari and Commodore have announced MS-DOS PC compatibles.

In large part, the spread of MS-DOS machines to the home and personal market is being powered by inexpensive offshore manufacture, either of the entire system or of components that would be far more expensive from domestic sources. Some companies achieve additional cost savings—and consequently lower retail prices—by substituting plastic for metal housings, and by providing lower-cost keyboards, mice, and other peripherals.

Some firms—PC's Limited, for example—use higher-end components, but deliver lower prices through direct-to-customer marketing, eliminating the overhead that an in-place retail distribution system entails.

PC manufacturers will face their most severe test, though, in the retail marketplace—computer stores or mass market mechandisers—and discover whether or not there really is a wide consumer demand for MS-DOS PCs.

That Commodore and Atari, the two veterans of the home market, are scrambling to establish themselves as compatibles contenders, is an indication of the seriousness with which MS-DOS computers are being taken.

Commodore already has its MS-DOS machines on the market. The computers have found solid consumer response in Europe and Canada for several years, although at $999 for the single 360K disk drive, 512K RAM (expandable to 640K) PC10-1, and at $1,999 for the twin-drive, 640K RAM PC10-2 (monitors extra for either system), Commodore is priced higher than most of the newcomers to the market. Atari, on the other hand, has promised a package that undercuts even the lowest-priced compatibles.

Announced at last January's Consumer Electronics Show (CES), Atari's PCs come in two versions. For $499, the company hopes to deliver 512K RAM (expandable to 640K on the motherboard), a separate 256K RAM for video control, a single 5¼-inch disk drive, and a built-in color graphics adapter. In its announced $699 package, Atari will include a monitor and an enhanced graphics adapter (EGA), for a package more than competitive with any compatible on the market.

To compete, however, the machines must reach the market, and Atari has been plagued by delays in getting its hardware ready. Scheduled to appear on the market this spring, the roll-out date for Atari's PCs has been pushed back at least to late summer. And once the hardware is complete, there is a built-in 90-day delay as the machine awaits FCC approval. If those delays pile up too much longer, Atari runs the risk of missing the all-too-crucial fourth quarter, with what is expected to be a high consumer demand for Christmas PCs.

Both Commodore and Atari are aware as well that there are literally hundreds of compatibles-makers already on the market with low prices and increasingly aggressive marketing strategies. If this is the year of the PC, companies that don't get early exposure and shelf space, or are perceived as pricey, may find that a well-established name is not enough.

Pricing And Personality

The main PC competition is found in the $500–$2,000 price range, with many manufacturers discovering the greatest action among feature-loaded machines at the upper end.

PCs costing less than $1,000 tend to offer a single disk drive, 512K RAM, room for expansion both on the motherboard and through slots, and a monochrome monitor, along with software packages that usually include a version of MS-DOS, but otherwise vary from manufacturer to manufacturer.

The look and feel of the machines vary as well. Shoppers who take the time to learn their way around the various machines will discover that each PC has a personality of its own, reflective sometimes of manufacturing decisions, but also of the parent company's approach to the market.

Amstrad, for example, is an English electronics company entering the American computer market this year after finding phenomenal success throughout Europe. Its PC 1512 series includes three 512K RAM configurations priced below $1,000: the DM, with a single 360K drive and monochrome monitor for $799; the DD, with a dual drive and a monochrome monitor for $899; and the SDC, with one disk drive and a color monitor for $999. The company breaks the $1,000 price point with a dual drive (and color monitor) for $1,099. All Amstrad computers come with a large bundle of software, as well as a mouse.

One of the first things consumers will notice about Amstrad's PC 1512 series is the lightness of the computer's compact plastic box.

Weight and size reductions were achieved not only with plastic housing, but also by moving the computer's power source and fan into the monitor, which fits into a recess on top of the computer box. Design can have marketing ramifications as well—Amstrad buyers are locked into Amstrad monitors, and the company does not sell any of its components individually.

"Amstrad has a system not unlike racked stereo equipment," says Wally Amstutz, vice president of marketing. "Everything comes in two boxes—connect the system and plug it in, and you're ready to go."

The self-contained approach has paid off for Amstrad elsewhere. In England alone, Amstrad has achieved a PC market share comparable to IBM's, without shrinking IBM's share.

"There is a wide consumer base that IBM and the other high-priced manufacturers haven't tapped yet," says Amstutz.

Amstrad will be seeking to tap that market through a network of independent dealers that will include computer stores and specialty electronics retailers.

Some manufacturers feel that if the PC is to find a mass market measured in millions of units sold each year, PCs need to be sold through leading retail chains. That's the strategy being put to the test by Blue Chip Electronics, whose Blue Chip PC XT is currently sold in chains including Target and Caldor, with tests planned for marketing through Toys "R" Us and the nearly 1,000-store Walmart chain.

Because it is seeking exposure through mass market retailers, Blue Chip hews more closely to lower-end price points than some of the other compatibles makers.

With 512K RAM (expandable to 640K on the motherboard) and a single 360K 5¼-inch disk drive, the Hyundai-built Blue Chip XT currently retails for $699, with a green monochrome monitor available for an additional $99. The XT can also be used with a television set serving as its monitor.

Aware that the market is broadening and that price is a key factor, Blue Chip is planning some product changes for later this year. At press time, the nature of those changes had not been made final, but it is believed that they will include a price cut of at least $100, enhancements of the hardware, and a bundled package of software.

Even the packaging will be designed with mass market retailers in mind, states Blue Chip founder and president John Rossi.

"It comes in a four-color box with a handle," Rossi says, "and, since it can be run on a television, is pretty much self-contained." Rossi's hopes are that, since the box contains DOS and a large bundle of applications software as well, the Blue Chip will be seen as a one-stop computer purchase.

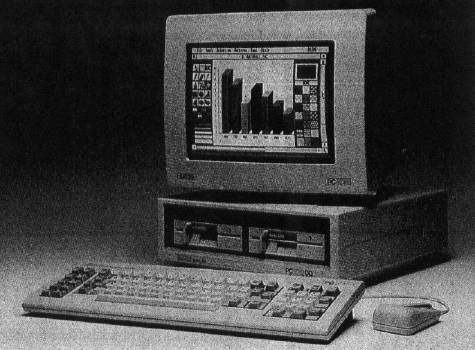

Leading Edge has established itself over the past year as a contender with its $1,075 Model D. Delivering 512K RAM (expandable to 768K), two 5¼-inch disk drives, a Selectric-style keyboard, and a monochrome monitor, the Model D also comes complete with MS-DOS 3.1 and Leading Edge's proprietary software bundle. The Model D is available in a color monitor configuration, although the company is planning to introduce a proprietary EGA monitor, with an anticipated retail price below $500. John Sullivan, vice president of Leading Edge hardware products, notes that the company is marketing its computer through a combination of computer retailers, value-added resellers (VAR), specialty stores, and office products stores.

"Leading Edge has always based its marketing strategy on including in the basic package items that other manufacturers offer only as options," Sullivan states.

There is already one major player involved in the mass market retailing of PCs. That, of course, is Tandy; through its Radio Shack chain of electronics and computer stores, it offers potentially more than 7,000 outlets for Tandy's computers.

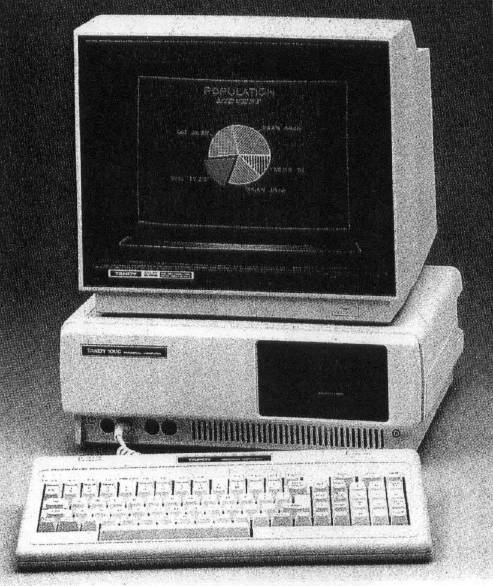

Tandy's under-$l,000 PCs include the 1000 EX, which delivers 256K RAM (expandable to 640K through Tandy's Memory PLUS Expansion Adapter) and a single 360K 5¼-inch disk drive for $599, and the SX, with two 360K disk drives and 384K (also expandable to 640K) for $999. Monitors are sold separately, in monochrome at $150, and in color at $250. A software bundle is included with the computers.

A marketing advantage that Tandy may enjoy in addition to its large retail presence is its existing penetration of the business community. Ed Juge, director of market planning, estimates that Tandy sold more than a quarter-million MS-DOS computers in 1986, and anticipates even higher figures this year. Of those 1986 sales, a substantial percentage was to small and medium-sized businesses.

"We sold more MS-DOS business computers last year than anybody except IBM," Juge maintains.

Exposure to Tandy computers in the workplace will go a long way toward persuading consumers to shop Radio Shack for their home computer, the company feels.

While many of the compatibles manufacturers and marketers are busy seeking or shoring up their retail outlets, PC's Limited, of Austin, Texas, has found success with a wholly different approach.

The company eschews retail altogether, pursuing an aggressive direct-to-consumer marketing program based upon a heavy advertising presence in computer publications. The direct-response ads provide a toll-free phone number, putting the consumer in contact with the manufacturer—and the manufacturer in contact with the actual end user—allowing for custom configuration of each system, if desired.

In the under-$1,000 market, PC's Limited offers its Turbo PC, which includes 640K on the motherboard, two 360K floppy disk drives, an AT-style keyboard, and a monochrome monitor.

Elimination of the overhead that accompanies distribution through traditional retail outlets has enabled PC's Limited to retain metal housings and full-sized keyboards, two features that many compatibles manufacturers compromise in order to keep prices low.

"Our philosophy is to make the best computers with the best components, and make them affordable," says the company's founder, chairman, and chief executive officer Michael Dell.

While PC's Limited's primary market is the medium-sized business, the company has found some success among individual consumers as well.

A new player in the American market is Vendex Pacific, whose Turbo-888-XT was expected to be on sale in mid-May.

Harry Fox, Vendex's vice president in charge of U.S. operations, notes that the dilemma facing manufacturers seeking to tap the consumer market is that market's diversity.

"To succeed," Fox says, "a company has to have a machine that will serve the first-time user, but also meet the needs of the more experienced computer user."

Priced at $995, Vendex's Turbo-888-XT is configured with 512K RAM, two 360K floppy disk drives, a full-size AT keyboard, MS-DOs' 3.2, and a monochrome monitor. The system is available with an RGB color monitor at $1,295.

Franklin Computer has been perhaps best known for its ACE series of Apple compatibles. With its $799.95 PC-8000, Franklin Computer is now positioning itself for the PC consumer. Offering two disk drives, 512K RAM (expandable to 640K), and MS-DOS 3.1, the system is configured to support a monochrome monitor, available for $139.95. Franklin also offers a single disk drive system, the PC-6OO0, for $699.95.

Having achieved substantial success in the cash-register, adding-machine, and calculator markets, Victor Technologies is entering the PC field. Victor's under-$1,000 PC, called Champion, offers 640K RAM, DOS 3.1, and a single disk drive for $799. A monochrome monitor is available for $119.

Bundles Of Software

Like many of the manufacturers pursuing the PC market, Vendex has added a bundle of software to its system including a tutorial aimed at assisting the first-time computer user.

Called Headstart, the proprietary software was designed for Vendex by Executive Systems, and includes popular applications such as word processing, spreadsheets, RAM-resident pop-up features, and a program designed to train the new computer user in the Turbo-888-XT's operation.

"Essentially," Fox states, "we've put the manual onscreen, letting the consumer guide himself through the tutorial using only the cursor and enter keys. The program lets consumers learn to use their computer by actually using their computer." Vendex hopes that the package will live up to its description as "user seductive."

Once acquainted with the operation, users can extend the "point-and-shoot" approach to utilities customized by Vendex for the Turbo-888-XT. Experienced computer users, of course, need not employ the tutorial.

Amstrad's approach to software includes bundling two operating systems—the traditional MS-DOS 3.2, and Digital Research's DOS Plus and GEM (Graphics Environment Manager), which together form a mouse-driven graphics package. Included in Amstrad's GEM are applications such as GEM Paint for creating pictures, and GEM Desktop, with pop-up applications including a calculator and a clock.

"We think the public will be very excited about the GEM environment," notes Wally Amstutz. "And Amstrad will also be offering a window-driven BASIC that should find a good consumer response."

Blue Chip is currently in negotiation for its software package, which, according to John Rossi, will provide a word processor and a database manager. MS-DOS is included. Through arrangements with software manufacturers, Blue Chip's customers will be able to use coupons toward the purchase of more complete manuals and support from the software vendors themselves.

Leading Edge includes DOS 3.1 and a proprietary word processing program in its Model D package.

At Tandy, the bundled software is called Deskmate II and comes complete with a word processor, spreadsheet, database, telecommunications program, calendar, and an electronic mail program. MS-DOS 3.2 is also included with Tandy computers.

PC's Limited, because of its targeting of the business market, includes only system software with its package.

Victor is providing word processing and spreadsheet software with its Champion computer.

Whether or not software bundles will contribute to increased sales remains to be seen, but the variety of bundles shows that each manufacturer is developing its own software, as well as hardware, profile.

Consumer response will finally determine what the public actually wants or will come to expect in terms of bundled software accompanying their, computers.

Memory

One thing that consumers do already seem to want from their PC is a lot of memory.

The PC industry standard now is the 512K RAM motherboard, but more and more companies are either offering initial 640K motherboards, or are designing their machines to make them easily expandable to 640K and higher RAM levels. That much memory is required to run large spreadsheet and text-processing operations along with RAM-resident programs which offer keystroke access to notepads, alarm clocks, calendars, and other conveniences without leaving the program being run.

If large amounts of RAM are vital to successful competition in the PC marketplace, vast amounts of storage are increasingly important. Many of the most popular PCs come with built-in hard disks capable of storing 10, 20, or more megabytes of programs and information.

Amstrad, for example, has already found the greatest consumer response to be for its 20-megabyte PC 1512 HDC with a color monitor, a configuration retailing for a still-competitive $1,799.

Wally Amstutz notes that Amstrad has been pleasantly surprised by the enthusiasm for its larger configuration.

"Buyers are becoming more knowledgeable about what they want in a computer," he says, "and their awareness of the options a hard disk offers are coloring their decisions." Among those options are fast loading of programs directly from hard disk storage to RAM, and easy internal storage of both applications programs and their own work.

PC's Limited has found its greatest success with its 286 line of compatibles carrying an internal 30 megabytes of storage.

Franklin's PC-8000 is complete with a power supply able to support 10- and 20-megabyte hard disks.

As Vendex prepares for the debut of its Turbo-888-XT, its emphasis is focused upon the introductory, floppy-disk-drive-only configuration.

"We are definitely planning to offer a hard disk configuration before the year is out," notes Vendex's Harry Fox. "And the system is set up now with five full expansion slots available for consumers who want to go ahead and install a hard card."

Leading Edge is taking mass storage one step further than hard cards or hard disks. Having upped its hard-disk option from 10 to 20 and again to 30 megabytes, the company is now offering what it calls the "Leading Edge Infinite Memory System." Rather than a hard disk, the Infinite Memory configuration employs a Bernoulli Box.

Developed by Iomega, and named for the eighteenth-century Swiss physicist and mathematician Daniel Bernoulli, the Bernoulli Box utilizes a fixed cartridge reader and removable mass-storage cartridges rather than fixed disks.

"Each Bernoulli cartridge holds 20 megabytes of memory," observes John Sullivan. Leading Edge provides two cartridges with the Infinite Memory System, which is an upgrade of the Model D PC. Additional 20-megabyte cartridges are available for $49.95. The Infinite Memory System itself sells for $1,995.

Also entering the removable mass-storage market is Victor, whose VPC III 286 carries a removable 30-megabyte fixed disk drive, with 640K RAM expandable to a megabyte. Victor anticipates marketing the VPC III 286 for $2,395.

Expandability

Another question addressed by the PC manufacturers is expandability. While few manufacturers as yet see the general public as eager to take screwdrivers in hand, open their computers, and begin swapping cards and chips, all are aware that a portion of their market is interested in performing its own upgrades.

Expansion slots, serial and parallel ports, and peripheral connectors are becoming important features emphasized in product literature.

"We took a lot of care," says Harry Fox of Vendex, "to offer every essential expansion option, and some extras."

Fully configured, the Vendex Turbo-888-XT leaves five standard IBM card slots open, allowing consumers to custom-configure their own upgrades.

Amstrad has eliminated the need for removing the computer housing. An access port is built into the top of the machine, enabling owners to add cards easily. The PC 1512 provides three expansion slots.

With the Leading Edge Model D, consumers have the option of upgrading with four IBM slots. Leading Edge will also be offering a proprietary EGA (Enhanced Graphics Adapter) within the next year.

Tandy expandability varies with the model purchased. Their model 1000 EX can be expanded only with Tandy's proprietary One PLUS and Two PLUS expansion boards, while the 1000 SX has five 10-inch expansion boards available.

Service

Manufacturers are increasingly aware of the premium consumers place upon service. This is especially true with electronic products, and manufacturers are responding to consumer expectations.

While PC's Limited, as a direct-to-consumer seller, has relied previously on telephone technical support for customer problems, the company is in the process of introducing an optional on-site service contract.

"For $35 the first year, our customers will be able to have a service technician come to their site should there be a hardware problem," states Michael Dell.

Dell feels that service is essential for manufacturers who intend to grow with their market. "Customers have to be aware that there is more to your company than just 'Here's your box,'" he says.

Leading Edge dealers function as service centers for that company.

At Vendex, the on-site approach has been extended to the initial installation of the machines.

"We're aware of the trepidation that some consumers feel even after they've bought their computer," says Harry Fox. "And while we've addressed this with our onscreen training program, we're also offering on-site installation.

"For $49.95, the customer can have a bonded installer come to his home or office and set up the computer, including an initial orientation to our configuration." Vendex will provide a toll-free number through which customers can arrange for further service.

Tandy customers have access to 166 service locations in the Radio Shack chain, Ed Juge notes. If one of those service centers is not nearby, the local Radio Shack can forward the computer to a service center.

Proud of this capability, Ed Juge says, "Tandy has the strongest support and service network of any PC manufacturer, even IBM."

Amstrad will be arranging service and support through its network of independent dealers.

At Blue Chip, service is currently accomplished at the company, but a service network will soon be in place nationwide.

PC warranties and guarantees vary from manufacturer to manufacturer, with most of them offering a one-year warranty on parts.

Add-On Markets

As Vendex's Harry Fox has noted, personal computers serve a disparate market. While the immediate focus is tapping the large consumer audience, manufacturers are also aware of the potential for sales that can be found in schools and small businesses.

Tandy's Juge observes, "We have had a stronger presence in the schools than a lot of people realize." Stressing Tandy's ongoing commitment to the educational market, Juge points out that the company is offering the same 20-percent school discount offered by Apple, widely recognized as the leading supplier of educational computers.

Amstrad, too, hopes to penetrate the school market, although Wally Amstutz notes that this may have to wait until the company's network of dealers is more firm. The company's preference is to permit its distributors to market to their local educational systems and institutions.

PC's Limited has always seen the non-Fortune 500 business market as among its prime customers, and will continue to do so, says Michael Dell, although he sees his company increasingly going head-to-head with IBM and Compaq for the upper-end business market as well. At present, the company's advanced 3086 line of computers is seen as offering business customers a cost-effective alternative to IBM and Compaq machines.

At Leading Edge, schools are seen as a natural market, especially as consumer awareness of MS-DOS widens. The feeling is that parents are going to want their children to learn computers that use the same operating system that they will face in the business environment.

Whither IBM?

It was IBM that gave the Personal Computer its name in the first place. With the company's announcement of its new Personal System/2 and the Microsoft Operating System/2 that is being developed for it, many feel that IBM is ceding the personal computer market to the compatibles and clones.

IBM's twin 3½-inch, 720K disk drive Model 30 provides 640K RAM and is priced at $1,695; with one disk drive and a 20-megabyte hard disk, it lists for $2,295. Other System/2 models offer a megabyte or more of RAM, 3½-inch disk drives carrying 1.44 megabytes, and fixed-disk storage devices with as much as 115 megabytes of memory. Prices for the various IBM configurations climb quickly and steeply, reaching a whopping $10,995 for the 2-mega-byte RAM (expandable to 16 megabytes), 115-megabyte hard disk Model 8580-111.

One of the things IBM is offering for these prices is enhanced graphics, enabling both color and monochrome users to achieve sharper monitor images.

At the higher end as well, IBM is betting on business interest in increased speed, with the Intel 80386 microprocessor delivering operations at rates up to 350 percent faster than the current AT processor.

But enhanced graphics is currently a high-priority item among the clone and compatibles manufacturers, many of whom are already delivering low-priced machines that accomplish their processing tasks faster than do IBM ATs.

What prompted IBM to move its marketing away from the MS-DOS standard?

Leading Edge's John Sullivan notes that IBM had seen its PC market share dwindle. "I think the new IBM machines are signs of the company taking a definite move to protect the market they have, and to buy some time to regroup and regain ground," Sullivan states.

Ed Juge of Tandy sees IBM in the process of circling its wagons and attempting to seal off the Fortune 500 market, which after all, has been the company's prime market throughout its history. Tandy sees IBM's new machines and operating systems exerting little effect on the broad consumer market for PCs.

"I don't see the new machines having much impact on the general consumer," Juge says. "For one thing, they're expensive. For another, it represents a departure from an existing standard in which people have a large vested interest in software and hardware."

One reason many compatibles manufacturers are sanguine about the new machines is that Microsoft is still refining the OS/2 software. Delivery of the finished software is expected to take at least another nine months, with some observers speculating that actual completion of the system could require years.

Michael Dell views IBM's announcement of its new machines as less a company marketing decision than a response to the latest advances at Microsoft. The software developer is now serving as the driving force in the PC environment, Dell feels.

Since his company is already a Microsoft OEM (Original Equipment Manufacturer), Dell does not feel threatened by IBM's announcement.

Among the advances being touted by IBM is the higher capacity 3½-inch disk. Do compatibles manufacturers feel obliged to follow IBM's lead with such disks?

PC's Limited already offers 3½-inch drives as an option, as will Vendex. John Sullivan of Blue Chip notes that his company has 3½-inch drives, and is enthusiastic because the manufacturing cost of such drives is less than that for traditional 5¼-inch drives.

Sullivan also observes that before the 3½-inch drive becomes a feature demanded by the general consumer, the amount of software available for such drives will have to increase.

Amstrad is taking a wait-and-see attitude at the moment, although 3½-inch drives are an option it is considering. Wally Amstutz notes that as personal computer upgrades become more common, it should be easy for the consumer or his or her service center to enhance the system to meet new demands.

"If 3½ becomes something everybody wants," Amstutz states, "you can bet that there will be an upgrade kit on the market for a couple of hundred dollars."

Should the consumer be concerned that IBM is going to lead the industry away from MS-DOS machines?

"Not at all," says Michael Dell, adding that the OS/2 operating system is an evolution of the industry standard operating system rather than an abandonment of it.

At present, in fact, OS/2 is expected to accommodate most MS-DOS software without difficulty.

Clones II

If IBM does succeed in creating a new generation of machines and prompting a new generation of software, will the clone and compatibles manufacturers be able to follow its lead?

The attitude on the part of most manufacturers is a resounding yes. The feeling is that if the public should want the new system, then the manufacturers will respond by making it affordable.

For the present, though, the emphasis is on establishing once and for all a market for the personal computer in the home.

"I think everybody needs to remember that this has been tried before," says Harry Fox, invoking Coleco's Adam and IBM's own PCjr. "Those failures set the industry back a couple of years, and we're really only just now recovering. But if we can deliver quality machines to the public, and show them that they no longer need to be afraid of computers, then I think the PC will be the success story of the next few years in home electronics."

For more information about the machines discussed in this article, the manufacturers may be contacted at the following addresses:

Amstrad

c/o Video

1915 Harrison Rd.

longview, TX 75604

Atari

1196 Borregas Ave.

Sunnyvale, CA 94086

Blue Chip Electronics

7305 West Boston Ave.

Chandler, Al 85226

Commodore Business Machines

1200 Wilson Dr.

West Chester, PA 19380

Franklin Computer

Route 73 I Haddonfield Rd.

Pennsauken, N] 08110

International Business Machines

Information Systems Group

900 King St.

Rye Brook, NY 10573

Leading Edge

21 Highland Cir.

Needham Heights, MA 02194

PC's limited

1611 Headway Cir., Building 3

Austin, TX 78754

Tandy / Radio Shack

1800 One Tandy Center

Fort Worth, TX 76102

Vendex Pacific

40 Cutter Mill Rd., Suite 438

Great Neck, NY 11021

Victor Technologies

380 El Pueble Rd.

Scotts Valley, CA 95066