BOND BROKER

Take on Wall Street with your Atari!

By Jeffrey Summers, M.D.

Use your Atari to help select your best investment from among the plethora of choices in bonds, CDs, money markets and mutual funds. Bond Broker is a BASIC program that works on all 8-bit Atari computers of any memory size, with disk or cassette.

Given the recent volatility in the stock markets, many people are looking at alternatives for investing their money. Bonds, bond mutual funds, and certificates of deposit (CDs) are popular alternative investments. They give a fairly constant yield and tend not to suffer from the same ups and downs as stocks.

CDs protect your principal better than bonds or bond mutual funds, but usually give lower yields. Individual bonds are only as stable as the organization that releases them (very stable if from the U.S. government, somewhat more risky when from corporations).

Many people try to reduce their risk by buying shares in a mutual fund that specializes exclusively in bond-type investments. These funds pool investors' money to buy many different bonds, which reduces the impact if one bond defaults. However, there are many different types of bond funds and choosing among them can be difficult. Bond Broker allows easy comparison of investments held from one to 20 years.

Money markets, bank accounts, bonds, bond funds, certificates of deposit (CDs) and treasury bills can all be compared. If you have a crystal ball about the stock market you can even compare estimated returns on stocks. However, you'll get the most reliable results when you compare investments that give a more dependable yield.

SOME TERMS

Before you use the Bond Broker program, you should understand the following standard investment terms.

A load is a sales commission paid when you purchase your investment. With a typical mutual fund load, if you invest $1,000 and there is a 5% load, you actually only have $950 working for you. The other $50 goes as a sales fee. End-load funds don't require a load up front, but rather at the end as a redemption fee.

The yield of an investment is its total income return, income which often flows from different categories. Annual yield for bonds and similar investments consists of the interest percentage received per year plus any capital appreciation, which is the amount that the resale value of your investment grew during the Year. Bond prices tend to rise when interest rates fall, and vice versa. Thus, some funds oriented toward high interest might not perform as well as a fund whose bonds appreciate in value and give interest. Usually the yield for the past several years will be in the fund's prospectus.

In investments such as CD's, money markets and regular bank accounts, the capital appreciation or capital gain, is less important, and the yield can be considered the same as the annualized interest rate. So if you have $1,000 invested with a 5% total yield, at the end of the first year you should have $1,050.

Compounding refers to reinvesting your dividends. If you do that, your next year's return will be based on the higher investment. If you reinvested your $50 dividend, you'd have $1,102.50 at the end of the second year instead of $1,100 because the 5% yields are based on $1,050, not $1000. However, if plan to live off the interest, you obviously can't reinvest the dividends.

Some funds charge a load on your reinvested dividends. To properly compare them, you'll need to know whether your funds do or do not change a load. So if you have $1,000 invested in a fund with a 7% load and a 7 % yield, at the end of the first year you'll have broken even, right? Wrong. Your 7% yield is only on 93% of your total investment, so you lose a bit after one year. This is the sort of problem that makes the Bond Broker program necessary.

Let's run through an example. Recently, one high-yield bond fund was giving a 12.62% yield. This fund, which we'll call ABC, is a no-load fund--no sales commission is charged. Another fund, XYZ, yielded 13.12%. This fund, however, charged a 5% load except on reinvested dividends. Which fund is the better investment? We'll use Bond Broker to find out.

GETTING STARTED

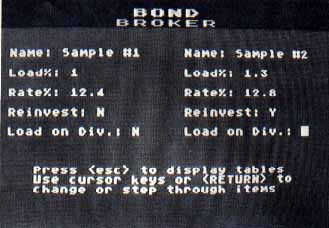

Type in Listing 1, BOND.BAS, check it with TYPO II and SAVE a copy before you RUN it. RUNning the program brings up a two-column screen.

Bond Broker compares investments two at a time. The numbers that you will need to enter into the program are pretty much what you would expect to find in the sales brochures of any bond-type investment you are seriously considering.

To calculate our example, start by entering the name of the first investment, ABC, then press [RETURN]. The cursor moves to the Ioad% line. The default value is 0% and since this is a no-load fund we'll leave this number alone. Press [RETURN] again to move to the Rate% line. Now type 12.62, the percent yield for the ABC fund.

Press [RETURN] to get to the Reinvest line. If you don't want to reinvest, type [N] and press [RETURN]. Otherwise just press [RETURN]. You can try it both ways for the example.

Next we have the Load on Dividends line. The default is that dividend reinvestment does not carry a load, as is the case with our ABC fund. Press [RETURN] and the cursor moves up to the name of the second investment. Type XYZ, and [RETURN], then enter 5 for the load and 13.12 for the yield. As with ABC, again there's no load on reinvested dividends. If you decide to change values, move around with the [ARROW] keys. Once you're satisfied with all your entries, press [ESCAPE] to move to the second screen.

SECOND SCREEN

Here you'll see the names of your Investments followed by the total return for one to 20 years. Each column contains the amount your investement would be worth if you invested $1 for the specified number of years.

Often, investments with differing loads and yields will cross over. One investment would be better for the short term while the other would be better over the full 20 years. Thus, if you are saving for a car in three to five years, you may desire a different investment strategy than if you're saving for retirement in 20 years.

In this example, the funds cross over between the eleventh and twelfth years. If you think you will want to change investments or use the money before then, you should invest in the no-load ABC fund. If you will be holding the fund longer, the XYZ fund will give you a better long-term yield.

Pressing the asterisk[*] will return you to BASIC. Pressing [ESCAPE] returns you to the first program screen, where you can make changes in your data or compare two new investments. Note that after making a change in a number, you don't always have to press [RETURN]. If you do, you'll go to the next entry, but you may use the [ARROW] keys both to terminate your entry and to move to a different position. [ESCAPE] will also accept your entry before switching screens.

You can keep the better of the two investments as it is and change the other, or play "king of the hill" with different investments until you find what's best for you.

Rochester physician Jeffrey Summers is a frequent Antic contributor; most recently with the May 1988 Super Disk Bonus, Antic Data-X.

Listing: BOND.BAS Download